Monthly Maintenance Needs Allowance (MMNA): What Does it Mean and How do Calculate it?

- Amber Hinds

- May 15, 2020

- 4 min read

In our previous blog post, we discussed how to calculate the Community Spouse’s Resource Allowance when dealing with a married couple wherein one spouse is institutionalized (the institutionalized spouse) and one spouse remains living in the community (the well or community spouse). We mentioned that in 1988 Congress enacted Spousal Impoverishment provisions to prevent the community spouse who is still living at home in the community from becoming impoverished/with little or no income or resources. Under the Medicaid Spousal Impoverishment Provisions, a certain amount of the couple's combined income & resources is protected for the spouse living in the community. The previous blog post addressed the Community Spouse Resource Allowance (CSRA) which is the amount of countable resources a community spouse is allowed to keep when the institutionalized spouse applies for Medicaid. The CSRA deals with the couple’s assets or resources. Today, we’re going to shift our focus from the couple’s assets to the couple’s income. The Monthly Maintenance Needs Allowance (MMNA) is the minimum amount of monthly income the community spouse is entitled to. If the CS does not have enough of his/her own monthly income to meet his/her Monthly Maintenance Needs Allowance (“MMNA”), he/she receives a portion of the IS’ income. Any income the IS has after shifting income to the CS will go towards the IS’ share of cost/co-pay.

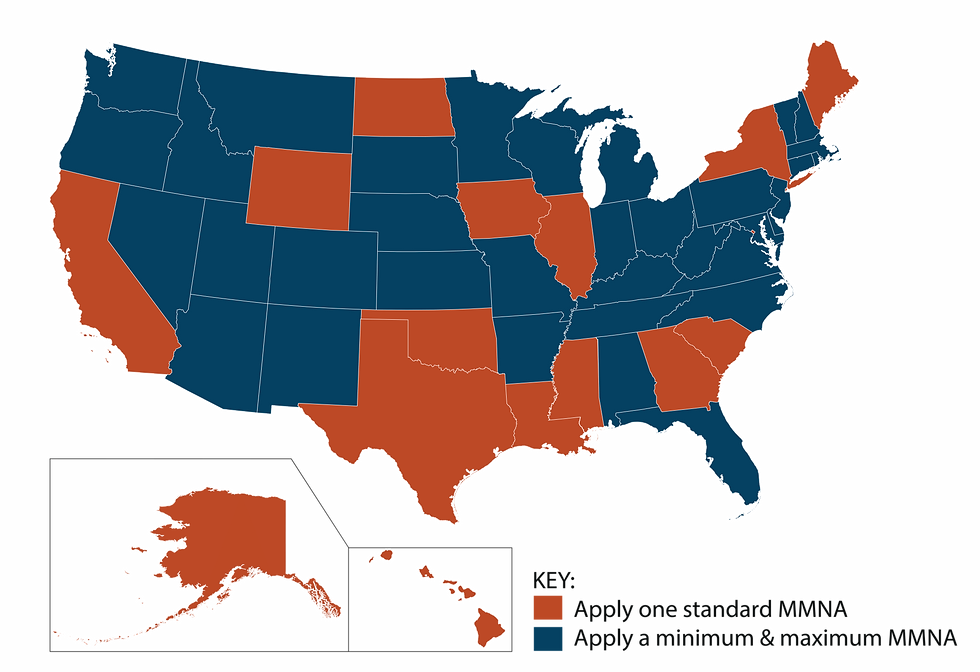

Similar to the CSRA, in order to determine how much income a community spouse can keep; we first need to establish if you reside in state that applies one standard amount for the CS to keep or if you reside in a state that has a minimum and maximum. State Medicaid agencies determine the CSRA one of two ways, as outlined below:

Some states apply one standard amount – the maximum.

Some states apply a minimum and maximum amount: generally between $2,114 - $3,216. The community spouse is entitled to a minimum MMNA plus excess shelter allowances – not to exceed the maximum MMNA.

The States in orange apply one standard MMNA whereas the States in blue apply a minimum & maximum MMNA.

Let’s consider an example of a married couple, Robert and Nancy.

Maximum State

Robert and Nancy are married. Robert is about to enter a nursing home and Nancy will remain at home. Robert has income of $2,500. Nancy’s income is $1,216. Their state rules say Nancy is entitled to the maximum MMNA ($3,216). Based on the couple’s income & MMNA, Nancy has a monthly income shortfall of $2,000.

The state will “divert” $2,000 of Robert’s income to Nancy which leaves $450 of Robert’s income to be paid to the nursing home. Here’s how the math works out:

First, we determine Nancy’s Income:

Social Security: $1,216

Next, determine if there is a shortfall:

Nancy’s MMNA: $3,216

Minus Nancy’s income: $1,216

Nancy’s Shortfall: $2,000

Lastly, we calculate Robert’s monthly co-pay:

Robert’s income: $2,500 Minus Income Shift to Nancy: $2,000 Minus Robert’s needs allowance: $ 50

Robert’s Patient Liability/Co-Pay: $450

Minimum & Maximum State

Alternatively, if Robert and Nancy lived in a state which only allows the minimum ($2,114), then Nancy would only be entitled to $898 of Robert’s income. Below is how the math works out here:

First, we determine Nancy’s Income

Social Security: $1,216

Next, determine if there is a shortfall:

Nancy’s MMNA: $2,114

Minus Nancy’s income: $1,216

Nancy’s Shortfall: $ 898

Lastly, we calculate Robert’s monthly co-pay:

Robert’s income: $2,500 Minus Income Shift to Nancy: $ 898 Minus Robert’s needs allowance: $ 50

Robert’s Patient Liability/Co-Pay: $1,552

In a Minimum/Maximum State, how do we increase the CS’ MMNA?

The community spouse is entitled to a minimum MMNA plus excess shelter allowances – not to exceed the maximum MMNA. If Nancy can show excess shelter expenses (a mortgage, utility bills, etc.) she can then receive more of Robert’s income, up to the maximum of $3,216. Excess shelter allowances mean expenses above the state’s shelter standard. If there is a remainder, that value is added to the minimum MMNA. Community spouse shelter costs include the community spouse’s expenses for:

Rent

Mortgage principal and interest

Taxes and insurance for principal place of residence, including renter’s insurance.

Any required maintenance fee if the community spouse lives in a condominium or cooperative.

The standard utility allowance established under the state Medicaid program.

All shelter costs are combined, then the state shelter standard is deducted from the remaining value. If the resulting figure is a positive number, it is added to the minimum MMNA. If the resulting figure is a negative number, the community spouse automatically receives the minimum MMNA.

For example, let’s assume we’re planning in a state like Pennsylvania where the minimum MMNA is $2,114, the maximum is MMNA is $3,215, the Standard Utility Allowance is $594, and the Shelter Standard is $635. All of these numbers can be found on our website here. We’ll assume the Nancy and Robert have a monthly mortgage payment of $800 per month and taxes of $200 per month.

We would add all of the following expenses:

Mortgage: $ 800

Plus Taxes: $ 200

Plus Standard Utility Allowance: $ 594

Total: $1,594

As you can see, our total equals $1,594. We would then deduct the Shelter Standard of $635 from the total of $1,594 to arrive at $959. Since this is a positive number, we add the remaining amount of $959 to the minimum MMNA of $2,114, so that the new MMNA becomes $3,073.

Comments